Rolling Stone reported that all across America, Wall Street is grabbing money meant for public workers. The legal theft of public pensions started in Road Island in 2011 as a test case. “In state after state, politicians are following the Rhode Island playbook, using scare tactics and lavishly funded PR campaigns to cast teachers, firefighters and cops – not bankers – as the budget-devouring boogeymen responsible for the mounting fiscal problems of America’s states and cities.”

Fortune Magazine in addition to In These Times, and KQED also reported on this legalized fraud being supported by corrupt elected representatives from the state level all the way to the White House.

In fact, during my full-time university days on the GI Bill [1968 – 1973] before I graduated with a BA in journalism, I learned how easy it was for the media to make mistakes—sometimes deliberately—while practicing what is known as Yellow/Hate journalism to boost profits.

And Yellow/Hate Journalism [based upon sensationalism and crude exaggerations] is what the Associated Press [AP] did when it ran Public retirement ages come under greater scrutiny by Don Thompson on December 14, 2011.

For instance, how would you feel if you read, “Patrick Godwin spends his retirement days running a horse farm east of Sacramento, Calif. with his daughter? His departure from the workaday world [he worked thirty-six years in public education and was the superintendent of one of California’s 1,600 school districts] is likely to be long and relatively free of financial concerns, after he retired last July at age 59 with a pension paying $174,308 a year for the rest of his life.”

That previous quote was in the second paragraph of Thompson’s AP news piece, and it is extremely misleading because of what it doesn’t say.

What the AP piece doesn’t tell us is that in 2010 the average member-only benefit for retired public school educators in California was $4,256 a month before taxes [less than a third of what Godwin earned in retirement] and that is only 16% of educators that retired in 2010 who worked as long as Patrick Godwin did. The median years of service was 26.6, and if you were one of the educators that retired after 26.6 years of public service [the median] and was only 55 years old [the earliest you may retire], using the CalSTRS retirement calculator, that person earned about $2,130 a month before taxes—much less than the $14,525.66 that Godwin earns each month.

I calculated once that if a public school teacher in California taught for 42 years or more, his annual retirement income would equal what he earned the last year he worked.

But—and this is a very large BUT that we never hear about—in public education, less than 4% retire with full pay. In fact, 9% retired in 2010 with 10-15 years of service in public education, 11% with 14-20 years, 15% with 20-25 years, 12% with 25-30 years, 23% with 30-35 years, and 16% with 35-40 years. — CalSTRS

The reason why AP ran with Patrick Godwin’s retirement income as an example is called sensationalism designed to cause an emotional response (hate) so people who don’t know all the facts will talk about it. Word of mouth attracts readers and an audience and that stirs the hate.

In addition, Godwin was a school district superintendent at the top of the public education pay scale, which represents about 0.2% of the total number of retired educators in California. That means 99.8% of public educators in California do not earn as much as Godwin did in retirement.

The result is that many readers might be fooled to think that most public educators in California will retire with Patrick Godwin’s annual retirement income. However, that is far from the truth since most will not come close, but Thompson’s biased and misleading piece didn’t say that

The reason AP distorted the facts about teacher retirement plans as much as they did is because of audience share, which determines how much a media source [TV, newspapers, hate talk shows, magazines, Blogs, etc] may charge to advertisers, and balancing the news and telling the truth often does not achieve this goal, because profits are the foundation of the private sector media.

It’s a simple formula: if you don’t make a profit you go out of business and everyone working for you loses his or her job so almost everyone plays the same Yellow/Hate Journalism game, and then there is the politics of money.

To understand why Thompson wrote such a misleading news piece, it helps to understand the trend away from private-sector pensions that were once similar to current public sector-pensions and the answers are in the numbers.

Due to the politics of money, beginning early in the 1980s, during the Reagan era, there was a rapid shift away from private sector employer-based defined benefit pension plans to employee-controlled personal retirement accounts.

teacher pensions explained

Under President Reagan [1981 – 1989] this trend in the private sector was helped along by the Republican Party that controlled the Senate from 1981 to 1987 giving President Reagan the leverage he needed to shift private sector pension money to the stock market and other risky investments—another part of the Reagan plan besides adding two trillion dollars to the national debt by cutting taxes on the wealthy; raising them on the working class by cutting deductions and spending more.

And since 1982 and Ronald Reagan’s infamous trickle down economic reform, profit expectations of American corporations have skyrocketed, and right behind have been the costs of health care, the cost of housing, the cost of military programs, the cost of banking, and the cost of many other products and services.” – The Agonist

In 1980, approximately 92 percent of private retirement saving contributions went to employer-based plans; 64 percent of these contributions were to defined benefit pension plans [similar to the public pension plans of today].

Then by 1999, [thanks to President Reagan and the Republican majority in the Senate while he was president] about 88 percent of private sector contributions were switched to defined contribution plans, the vast majority of personal retirement accounts being set up as 401(k)s and Individual Retirement Accounts (IRA), and that ended in disaster.

I suggest your either Google the failure of 401 (K) or read what PBS.org said, “Most people don’t know that the 401(k) products are toxic and their behavior toward a 401(k) product is toxic because no one has been responsible for providing a safe product.

“The Congress has not put itself [out] as a responsible actor. Employers were told, “It’s up to your employees to choose,” and the banking industry and the mutual fund industry said, “Trust us.”

If you are a regular fan of hate media and trust no other source, you will probably dismiss anything from PBS. But what about CNBC.com, Forbes.com, NBC News.com, USA Today, or even the Los Angeles Times. Will you trust one of those sources over your favorite hate radio show? If not, then I suggest you read this from Mother Jones.com to discover who is behind the lies designed to fool and why.

Back to the public sector retirement plans that did not follow the risky 401 (k) path to retirement. The Public Sector stayed with employer-based defined benefit pension plans such as the one I have through CalSTRS.

It helps that the union membership rate for public sector workers is 36.2 percent and that is substantially higher than the rate for private sector workers at 6.9 percent.

Discover how California is fixing its public pensions

To understand the numbers better and why the media focuses its Yellow/Hate Journalism circus act to attract the biggest hating mob, in November 2011, the Bureau of Labor Statistics reported that there were 20.4 million public sector employees [2 million work for the federal government—the rest work for the states or local county or city governments] and about 128 million private sector employees.

Those numbers help explain why the Associated Press ran the misleading Public retirement ages come under greater scrutiny by Don Thompson.

If you published a newspaper, a magazine, ran a TV news network, hosted a conservative talk show, or wrote a popular conservative Blog, which audience would you focus on to boost advertising rates? As I said, it’s all in the numbers

A, 20.4 million

B. 128 million

Another example of how misleading Don Thompson’s AP piece, Public retirement ages come under greater scrutiny, was: “With Americans increasingly likely to live well into their 80s, critics question whether paying lifetime pensions to retirees from age 55 or 60 is financially sustainable. An Associated Press survey earlier this year found the 50 states have a combined $690 billion in unfunded pension liabilities and $418 billion in retiree health care obligations.”

What Thompson also doesn’t mention in his AP piece is that some states managed their pension funds better than others did.

A March 2011 report on the Best and Worst State Funded Pensions by Adam Corey Ross of The Fiscal Times offers a more balanced picture. Ross wrote, “State pension programs across the country have undergone a major transformation, as more and more of them are cutting back the amount of money they set aside for retired workers, gambling that they can meet their obligations through investments instead of savings …”

In fact, Ross lists the best fully-funded state pensions that existed then, which were: New York, Wisconsin, Delaware, North Carolina, Washington, South Dakota, Tennessee, Wyoming, Florida and Georgia. He also lists the worst state pensions where the gamble did not pay off. However, with Governor Scott Walker in Wisconsin and Cuomo of New York, the public pension plans for those two states are probably doomed along with the public unions in those states if the voters don’t get rid of them in the next election.

California fell between the two lists, but thanks to recent legislations plans to fill the funding gap in a more sensible way. In addition, nowhere does Ross or Thompson mention that California has two state pension plans—CalPERS and CalSTRS.

As Public Pensions Shift to Risky Wall Street, Local Politicians Rake in Political Cash

The California State Teachers’ Retirement System [CalSTRS], with a portfolio valued at $189.1 billion as of June 30, 2014, is the largest teacher pension fund and second largest public pension fund in the United States. In addition, CalSTRS makes it clear that “it’s important to understand that the risk of facing depleted assets exists approximately 30 years from now versus actually facing insolvency today.”

Due to losses from investments during the 2008 global financial crises, the CalSTRS retirement “fund took an enormous hit to its stock portfolio when the market plunged during the heart of the recession, losing nearly $43 billion—roughly 25 percent of its value—from June 2008 to June 2009.”

However, in June 2014, California’s Governor Brown signed Assembly Bill 1469 to stabilize CalSTRS funding in an effort to bridge the nearly $74 billion funding gap that would keep the fund solvent beyond 30 years. Teachers’ Retirement Board Chair Harry Keiley said, “Educators in California do not receive Social Security for their CalSTRS-covered employment and the benefit they earn from years in the classroom serves as the cornerstone of their retirement income. Today’s actions further strengthen the Governor and Legislature’s commitment to uphold the state’s promise of a secure retirement to teachers.”

The vote in the State Senate was 37 – 0, and in the Assembly was 76 – 1. – legislature.ca.gov

Critics of public pension plans like CalSTRS will claim that the cost of these plans are bankrupting states, but that is false—in fact it is a damn lie. For instance, the current annual budget of California is about $156 billion. The state’s annual contribution to the CalSTRS pension plan is usually about $1.4 billion or 0.89% of the total state budget. With the 30-year plan from AB 1469 to stabilize the funding gap to uphold the state’s promise of a secure retirement to teachers, the state will be paying $1.9 billion annually to CalSTRS (instead of $1.4 billion) or 1.12% of the total annual state budget of California. – ebudget.ca.gov

It’s a fact that misery loves company and when the accountants, carpenters, clerks, plumbers, reporters, salesmen, and secretaries, and many other professions in the private sector, read the Yellow/Hate Journalism in Don Thompson’s AP piece, Public retirement ages come under greater scrutiny, many of these people in the private sector will say, “It isn’t fair. If we have to work longer and suffer, so do they.” In fact, that is already happening. Due to pressure from the private sector, this has led to: “Earlier in New Jersey, part of a legislative deal struck between Democrats and Republicans raised the normal retirement age from 62 to 65,” Thompson wrote.

Is Your Pension Safe? States Struggle With Pricey Challenges

On the other hand, when given a choice, many private sector employees do not save toward retirement other than Social Security. Many do not put money into 401 (k) plans or pay into tax deductible IRAs. Many that own homes take out equity loans to finance vacations, purchase new cars, pay off credit card debts, or go on spending sprees.

The result is that the average family in America cannot afford to retire as early as many public employees that paid into employer-based defined benefit pensions.

For example, total U.S. consumer debt was $2.43 trillion as of May 2011. Average credit card debt per household was $15,799. Average total debt in 2009 (including credit cards, mortgage, home equity, student loans and more) of U.S. households was $54,000. Source: Credit Card.com

As for me, instead of paying into Social Security while I taught, I paid 8% of my gross monthly pay for thirty years into CalSTRS, and the school district where I taught contributed a matching amount of about 8%. That means if I get any Social Security from the jobs I had outside of teaching, it isn’t going to be much.

In fact, to force public educators in California to work more years may cost more than it will save.

When I retired, the school district stopped paying me and saved the tax payers money since most teachers that retire after teaching 30 years or more are replaced by younger teachers that are paid much less.

Keeping older, higher paid teachers working longer will only cost the taxpayer more in the long run since those same teachers that are working longer will end up with a larger monthly pension check since the longer a teacher spends in the classroom, the larger the pension.

I’m impressed when a reporter does their job properly and balances the news instead of feeding the mob that bellies up to the slop-trough of Yellow Journalism, which is based on sensationalism and crude exaggerations.

Don Thompson’s misleading AP piece, Public retirement ages come under greater scrutiny did not impress me.

This is the summary of Retirement Heist: How Companies Plunder and Profit from the Nest Eggs of American Workers by Ellen E. Schultz.

However, Kevin G. Hall did. Hall writes for the The McClatchy Company, the third-largest newspaper publisher in the United States with 31 daily newspapers in 15 states. Hall provided a more realistic, honest balance of Why employee pensions aren’t bankrupting states.

In his piece, Hall wrote, “From state legislatures to Congress to tea party rallies, a vocal backlash is rising against what are perceived as too-generous retirement benefits for state and local government workers. However, that widespread perception doesn’t match reality.”

According the Hall, “Pension contributions from state and local employers aren’t blowing up budgets.” They amount to just 2.9 – 3.8 percent of state spending, on average.

In addition, Hall says, “Nor are state and local government pension funds broke. They’re underfunded …”

With those facts, we should ask what the real reason is why the far-right hate groups are turning on public-worker sector pension plans.

The answer may be Wall Street, Hedge Funds and US bank private-sector greed, the same risk-taking greed with someone else’s money that caused the 2007-08 global financial crises.

According The Council on State Governments, in 2006 before the crash, the total amount of money held by these federal, state and local public-pension plans was almost $6 trillion dollars, and greed—it seems—has no limits.

If you do not believe me, ask people such as Bernard Madoff [who robbed his victims of $50 billion], Scott Rothstein [$1.2 billion], Tom Peters [$3.7 billion], Allen Stanford [$8 billion], March Dreier [$400 million], Lou Pearlman [$500 million], Michael Kelly [$428 million], the Greater Ministries International Church [$500 million], Scientology minister Reed Slatkin [more than $600 million], and Nicholas Cosmo [$370 million].

Milton Friedman, the Nobel Prize winning economist, who said greed was good when he came up with the theory of trickle down economics, must be dancing in hell.

_______________________

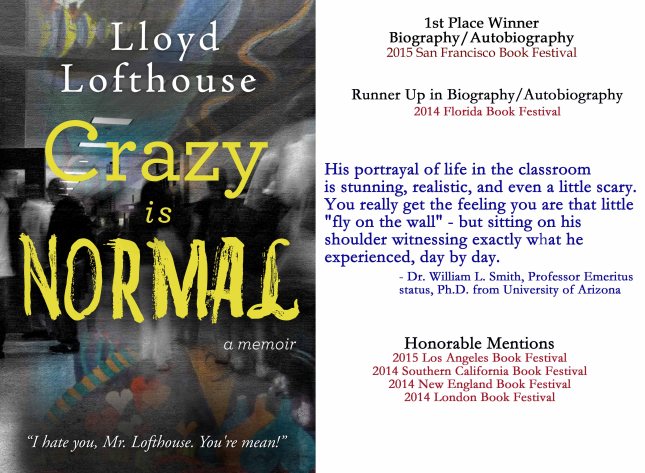

Lloyd Lofthouse is a former U.S. Marine and Vietnam Veteran,

who taught in the public schools for thirty years (1975 – 2005).

Lofthouse’s first novel was the award winning historical fiction My Splendid Concubine [3rd edition]. His second novel was the award winning thriller Running with the Enemy. His short story A Night at the “Well of Purity” was named a finalist of the 2007 Chicago Literary Awards. His wife is Anchee Min, the international, best-selling, award winning author of Red Azalea, a New York Times Notable Book of the Year (1992).

To follow this Blog via E-mail see upper right-hand column and click on “Sign me up!”

Callie

June 7, 2015 at 09:48

Good to know, but what is our elected government doing to stop it.

Lloyd Lofthouse

June 8, 2015 at 08:40

Not much, but on the glass half full side, this robbery varies from state to state. Some states are worse and some haven’t been raided YET, but it is obvious that every state will be attacked eventually in an attempt to take over the government there.

Elisabeth

June 7, 2015 at 09:51

When will this greed and robbery stop?

Talley

June 15, 2015 at 21:18

Shocking.

Lloyd Lofthouse

June 16, 2015 at 08:12

Yes!

Jennie B

June 16, 2015 at 00:00

They better give us someone to vote for in 2016 who is honest and doesn’t work for the fucking corporations.

Lloyd Lofthouse

June 16, 2015 at 08:13

I often wonder if that’s possible anymore.

langwell

June 18, 2015 at 11:16

Bastards! I’ll never vote for a Republican or Democrat again unless their every action and not their words prove they are not puppets of Wall Street and Hedge Funds. Go Green!

Lloyd Lofthouse

June 19, 2015 at 08:14

That’s what I’m thinking. Here’s a list of sites we can use to determine who walks the walk they talk.

http://votesmart.org/

http://www.technorms.com/454/get-your-facts-right-6-fact-checking-websites-that-help-you-know-the-truth

There’s also a site that tracks judges and compares their decisions to see if they are biased or balanced—meaning do they pass verdicts for friends and special interests who reward them with $$$ or focus only on the evidence to make a decision as fair as possible according to the law, but I can’t find the link for that one right now.

E Nash

July 11, 2015 at 11:03

We need to hang the thieves that are looting teacher retirements and vote the current government out—send all the frauds packing.

Lloyd Lofthouse

July 11, 2015 at 14:32

Yes!